Equivalised Income: How do you compare to other Australians?

MCJ Posted on

MCJ Posted on  Thursday, March 28, 2013 at 14:14

Thursday, March 28, 2013 at 14:14 Per Capita recently released their latest report into public attitudes toward taxation and government expenditure. Between this and the federal government’s contemplation of increasing superannuation tax rates for high earners, there’s been another round of discussion about incomes and who is “rich”. One of the aspects that, as always, struck me was the disconnection between how well off people are and how well off they think they are.

The ABS publishes data on household incomes, both gross (pre-tax) and equivalised disposable. I’ve pulled this data together so you can see where your weekly (household!) income falls relative to other Australian households. I guess it’s then up to you to decide how many people you want to be earning more than before you consider yourself “rich” (or high income, at least).

Gross income is perhaps easiest to measure, but equivalised disposable income is a better metric for a range of reasons. The main ones are that it takes into account that living with other people is cheaper than living alone (because e.g. you get to share appliances, rooms, etc.) and adjust for tax so you’re looking at what you actually have to spend.

Disposable income is your gross income less tax and Medicare; gross = pre-tax, disposable = post-tax. (Don’t know your post-tax income? Try the ATO tax calculator.) To equivalise your income, I’ve made this calculator for you; enter numbers for your household into the yellow boxes, and hey presto!

This calculator uses the ‘modified OECD’ equivalence scale.

Now, look up your weekly income on the table below.

The equivalent figures for gross household income look like this:

These data are nationwide, but you can dive into state-specific or capital-city/rural data via the above links if you prefer.

MCJ

MCJ

Grog’s Gamut has good post in a similar vein, with plenty of graphs. This one on equivalised disposable household income, in particular, I like:

Grog’s post on the current political debate over incomes and superannuation is a cracker, too.

MCJ

MCJ

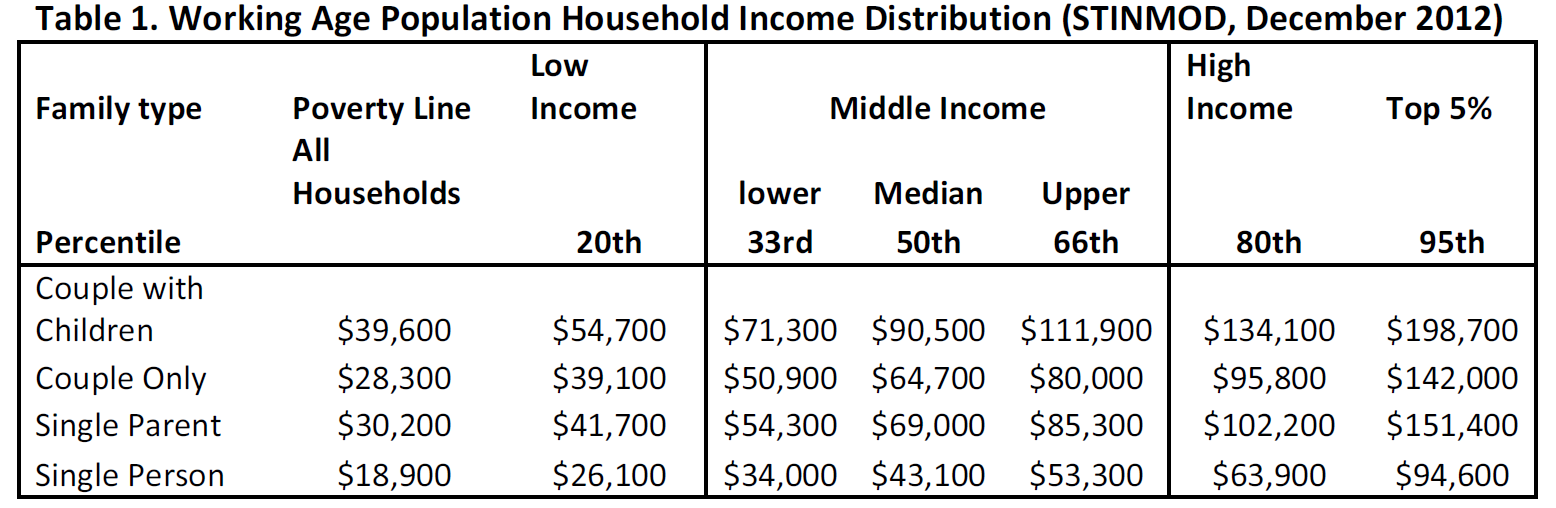

Also useful is this post by Andrew Spicer of CANSTAR. He points to a recent research note from NATSEM, Working Australia: What the Government Gives and Takes Away [PDF], which models the distribution of equivalised disposable incomes for different household types. See, in particular, Table 1:

The report notes:

The results in Table 1 are based on the equivalised disposable income for the working age population of Australia. We have therefore excluded a large part of the population where the head of the household is aged over 65. These excluded households are largely made up of aged pensioners and self-funded retirees.

Using the equivalised disposable income distribution we firstly split Australian households into percentiles (1 to 100 per cent). Defining low, middle and high incomes is a somewhat arbitrary process. We have chosen the middle as the middle third of the income distribution. We then define low incomes as the bottom 20 per cent and high incomes as the top 20 per cent. This leaves some households not clearly defined, these households could be categorized as lower-middle and upper-middle income households.

For interests sake we include the top five per cent and the poverty line. The poverty line used in Table 1 is half the median disposable income of all households including those headed by persons aged over 65 (without deducting housing costs as is used later in this research to compare relative standard of living). [p.2]

via @Justine_Davies_

MCJ

MCJ

Matt Cowgill rolls an updated version of my post into his excellent new contribution, “What is the typical Australian’s income in 2013?” Clear and comprehensive as always; go have a read.

Reader Comments (4)

Hi Martin,

very interesting & timely piece. In your calculator above - the field "What is the total income?" - Is that _disposable_ or gross income?

Phil

Hi Phil,

What income you enter is up to you: the calculator simply equivalises it. Whether you enter gross or disposable income, though, be sure to refer to the correct table afterward.

Hope that's clear,

Martin

Should the income amount entered be before or after centrelink benefits?

Kez,

Use income after benefits.